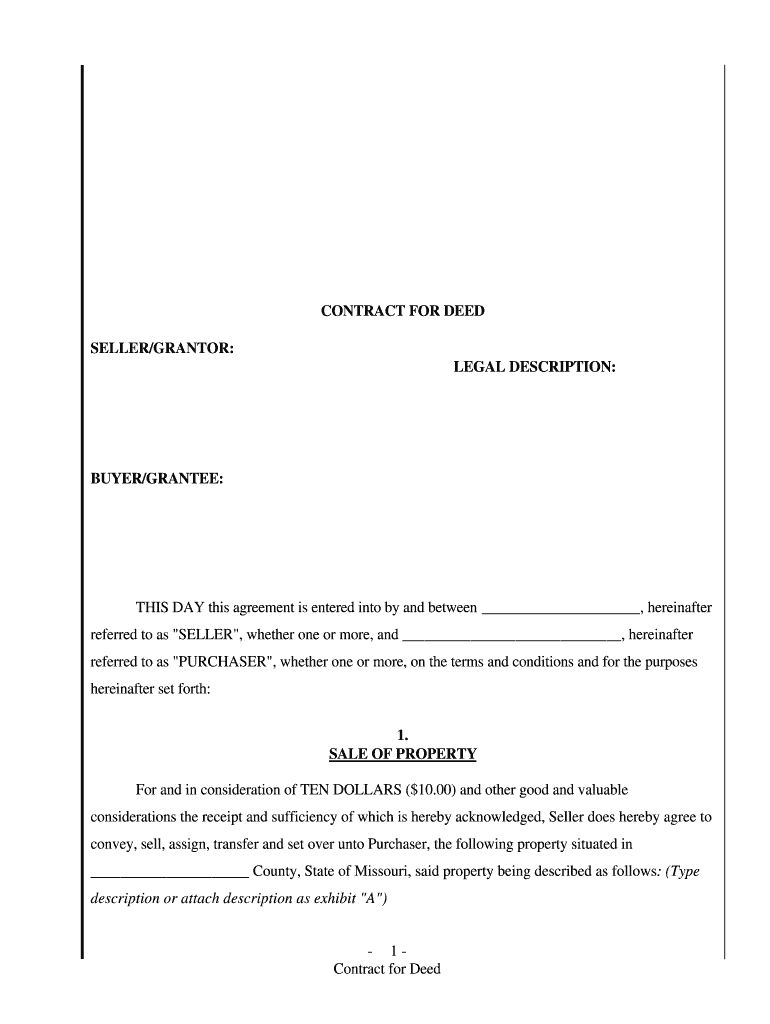

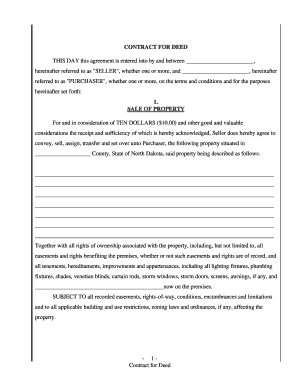

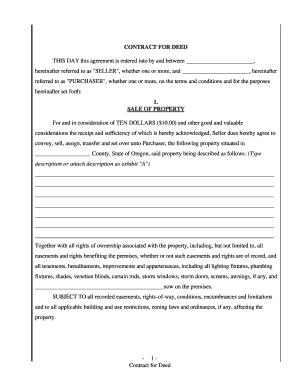

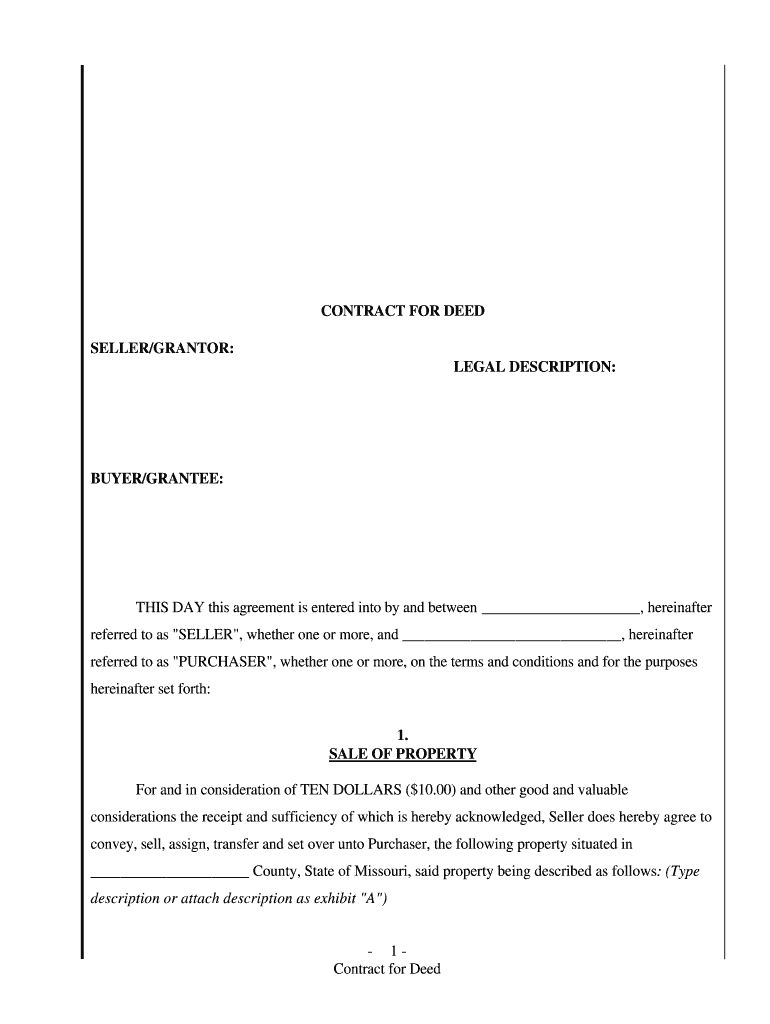

A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

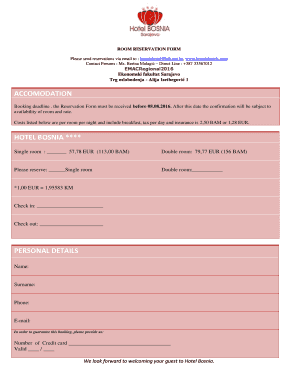

Get the free missouri contract deed sale

Get, Create, Make and Sign vehicle seller form

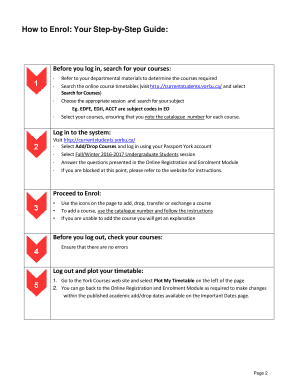

Editing MO Contract for Deed online

How to fill out MO Contract for Deed

How to fill out MO Contract for Deed

Who needs MO Contract for Deed?

Video instructions and help with filling out and completing missouri contract deed sale

Instructions and Help about MO Contract for Deed

Joe: The third one is a land contract or a contract for deed, depending on which state you're in. A land contract is simply an agreement to buy a property at a particular price with a particular interest rate with a particular payment plan over a particular period of years. It's very much the same way that you buy a car -- when you buy a car, you go out and get a loan from a standard lender, they take the title to the car, they hold onto that title, and they have an agreement with you to make payments to them to pay off the loan, and as soon as you pay off the loan then they transfer that title to you, and then you have that car free and clear. It's the same with the land contract. The seller, the person who's selling it to you, keeps the deed in their name, but they have another agreement with you, which is recordable -- you can take it down to the county recorder and record it -- saying that you're going to buy it over a certain period of time for a certain price and if you fulfill the terms of the agreement, then they're going to deed you that property after it's done. So that's another way to buy a property. Joe: They can have underlying mortgages on it. You never want to buy one that has mortgages on it that are more than the land contract. And with all land contracts, it should be standard that they can never finance it above what is still owed or remaining on the land contract, so that you remain safe as the buyer in that transaction. Joe: So when you start getting to this, this is the middle of the transaction, and now it becomes almost as safe for the sellers as it is for the buyer. If you default on this deal, if you're the seller of the transaction, you sold it on a land contract and that buyer recorded that land contract at the county recorder, then you're going to have to go through a judicial foreclosure to get that property back. It's not a problem and in a lot of places it's easier than going through a foreclosure on a mortgage, so it still makes sense for the seller. Joe: But, if you're the seller in the transaction, what you want to do is try not to have that land contract recorded, because a lot of times when we've had people who defaulted on land contracts that we've sold to them, it's been easy to agree with them, tear up the land contract and say, 'That's enough. We're going to put somebody else in that property. We're going to sell it to somebody else. We're going to put a tenant in there. Furthermore, we're going to sell it on a lease option; we're going to sell it outright,' or whatever it is we choose to do, and we can get that property back without going through a foreclosure process, and usually that buyer will allow us to do that without any argument. But if they record it, then you have to get it off the title, so it becomes more complex. So, if you're buying the property on land contract, make sure that land contract is recorded. If you're selling on a land contract, try not to have that land contract recorded....

People Also Ask about

Do you need a bill of sale for a car in Louisiana?

Can you sell a car without a title in Louisiana?

What is the person called who sells you a car?

What is a car seller called?

What is the safest payment method when selling a car?

What is another name for a car salesman?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in MO Contract for Deed?

How do I make edits in MO Contract for Deed without leaving Chrome?

How do I edit MO Contract for Deed on an iOS device?

What is MO Contract for Deed?

Who is required to file MO Contract for Deed?

How to fill out MO Contract for Deed?

What is the purpose of MO Contract for Deed?

What information must be reported on MO Contract for Deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.